What to do if you've lost your engagement or wedding ring in your house or elsewhere

If you've lost a ring that's very precious to you, it's often a very emotional situation. It's difficult (possibly impossible) to put a value on something as unique and memory filled as your engagement (or wedding) ring. Staying calm helps you to think straight, so take a deep breath first. We've put together a list of 43 places you can look for your lost ring in your house for you. There's also a brilliant tip (gained from experience!) to help you (hopefully) find your ring. If everything else fails, you can use your home insurance or specialist insurance to help you recover some of its cost and claim for your lost ring. It might help you purchase a replacement or have a replica commissioned.

Lost your engagement ring on a carrot?

Here's a true story. Whilst there are many examples of people loosing their ring in the sink, or accidentally dropping it in the bin, gardening is also a big culprit. However there are miracle stories too like this lady whose ring turned up 12 years later.....on a carrot freshly dug out of their vegetable patch! Proof that you should never dispair, even if you don't find your ring immediately. It might turn up in the most unusual of places.

What to do if you lose your wedding or your engagement ring

How to find a lost ring in your house

Here's a handy list of 37 42 43 places where your ring might have hidden itself:

- Under the bed.

- Under the rug.

- Inside the hoover.

- Open your fridge and look inside - we found our car keys in there once, so you never know!

- Rummage inside your freezer if you have a chest type one - in particular if your ring was a little loose on your finger

- In your kids jewellery box (no kidding - they like shiny things!!)

- In the car's glove box - true story!

- Check your jeans and trouser pockets.

- In your handbag.

- Don't forget to check your other half's make up bag (it's happened!)

- Inside your purse.

- Your gym bag - happens more often than you think

- Whilst at the gym, check under all the machines too ( yes it's another real story)

- On your keyring - one of our friends used to slide her engagement and wedding ring on it at the start of weight lifting sessions...then forget they were there.

- Have a look inside your laptop bag.

- Inside gloves (winter gloves, ski gloves too).

- Inside a pair of shoes.

- Look at the bottom of your slippers - especially if you've gone away and might have stored them there when packing.

- Kitchen drawers.

- Clothes drawers.

- Look inside all the pockets of your wash bag.

- Have a look behind your bedside table.

- At the bottom of the dirty laundry basket - they could have been in the pockets of your trousers or a top and fallen all the way down there.

- Double check all your aprons - for example if you've been cooking or baking in particular

- In a flowerbed (although technically not in the house!).

- On the side of the bath tub.

- Inside the washing machine.

- In the clothes dryer filter.

- On the floor.

- In the creases of the sofa.

- Under the sofa.

- In the dress up fancy clothes box.

- Under your pillows.

- Inside the bed.

- Under a pile of mail.

- In the spare change pot - you know, you empty your pockets of loose change and forget your ring was in that pocket too

- On the window sill next to the sink

- In your plant pots

- In the original box your ring came in - oh yes it happens

- In your golf bag (especially the little pockets where you store the balls...or the tees)

- In the garage

- In your box of bits and bobs - you know, where you put all the teeny things you find everywhere in the house, like screws, bolts, loose change....

- Ask your kids whether they have hidden it as a funny trick (don't believe us? Read Damian's story below!)

Cambridgeshire based wildlife photographer Alice Hunter told us "3 weeks ago, my hubby lost his wedding ring. We searched high and low with no joy, borrowed a metal detector and still no luck. This evening I cleared out a box of bits and bobs that he uses almost daily and found it... It started a good day, it ended a great one!"

(Big thank you to all the people on social media who have suggested all those places. If you found your ring somewhere else, let us know by sending us a tweet @ClaimScoreUK and we'll add your suggestion to the list. You might be the difference between a lost and a found ring for someone else one day...)

Still can't find it? Don't despair though as sometimes, rings re-appear as if by magic...Just check out our 3 real live stories below if you don't believe us.

Brilliant tip to help you find your lost wedding or engagement ring

If you've lost your engagement ring, wedding ring (or anything valuable), start by slowly retracing your steps to the start of the day. You'll need to do exactly the same things, open the same cupboards and drawers, go to the same corners of the room....But it's worked several time for us, often revealing the ring in a place you had completely forgotten about. Life is very busy. We don't always pay full attention to what we are doing. Sometimes we get distracted by a task in hand or someone talking to us. If you slip your ring off your finger when this happen, you might not make a good mental note of where you leave it.

If you still have no luck finding your ring you probably need to claim for it under your home or jewellery insurance.

4 incredible stories of lost and found wedding and engagement rings

This is the proof that you should always keep your ring on your finger or somewhere safe, get it adjusted if it become to loose...And whatever happens, never lose faith that it might turn up eventually!

Lost wedding ring in a bonfire

Founder of Expert Virtual Assistant Services, West Sussex based Emma Waterer witnessed her dad loosing his ring in a bonfire! "When I was a kid, we used to spend a fair amount of time at my auntie's house as my dad (her brother) was supporting her after her divorce. He would help out around the house and garden doing jobs etc. One day he had built a bonfire in her back garden and whilst throwing on various bits of garden debris, he 'flung' a load of stuff on hard enough for his wedding ring to fly off...into the flames. My mum wasn't best pleased but there was nothing to be done until the next day when the fire had cooled enough for him to poke through the ashes and thankfully retrieve the missing ring." Emma added that, happily "It wasn't a bad omen and my parents celebrate their 52nd wedding anniversary this year in 2019".

Engagement ring lost in the sand: magical happy ending

Nancy Squires was living in St Lucia age 22/23. She recalls: "My English boyfriend proposed with a ring bought from the local emerald shop. We would spend many weekends at the beach and were there with some friends. They were all swimming in the sea, but I was a bit nervous so was pulling myself around in the shallows with my hands. I felt the ring slip from my finger, stopped in place and called to my friends to help look for it. Even though I had not moved my hand no one could find it, as it had slipped into the sand beneath the waves. We had to leave, but knew someone, who new someone from the local US Airbase who had a metal detector. He agreed to look for it. The next day a tropical storm came through whipping up the sea and the man could not get to the beach for 2 weeks. We went with him to watch. After about an hour he asked me to describe the ring and then said he had found it. I couldn't believe it! 2 weeks later and right where I thought I had lost it there. And it was even more sparkly after having been tossed about in the sand for two weeks."

Engagement ring hides behind washing machine for years

Sue Howard told us how she had lost her engagement ring for 2 years when it finally turned up: "I must have put the ring on top of the washing machine while loading it, turned it on and forgot about it. I looked for the ring, not sure how long, maybe 2 years. I really thought I had lost it. Eventually, the cleaning bug must have got me. I pulled out the machine to clean behind it and...low and behold, covered in fluff and dust was my ring!".

"The joyous feeling I had when I found the ring will always be with me" added Sue. We bet!

Wedding ring gone? Ask your kids about it!

Damian Cullen, Health and Family Editor at The Irish Times in Dublin, Ireland was cleaning the bedroom one morning and spotted a coin under the skirting board. Damian explained "Trying to get it out, I only managed to push it further in. Using the inside of a pen, I managed to coax it out and saw what I first thought was another coin behind it. It was my long-lost wedding ring!" Damian added "I lost the ring just before Christmas, 2017. I take it off a bit and sometimes forget to put it back on immediately. I don’t sleep with it on – I was in the habit of putting it on the locker beside the bed. And I would often take it off if I was doing some manual work. And so when I missed it in late 2017, I didn’t panic. I was sure I had it last on the bed-side locker and so it would just turn up. But after a few weeks I started to doubt myself as to where I could have lost it (could it have been in a gear bag or a pants pocket?) It wasn’t particularly tight on my finger, so it was also possible it could have come off my finger without my knowledge.

This wasn't the first time Damien had lost his wedding ring. About 10 years ago, one of my daughters expertly hid my wedding ring in a small hole at the back of a bookcase. It would still be there only she asked me one day if I gave up on trying to find it! But I can’t blame the children this time – it obviously fell off the locker and got into a tiny gap between the skirting board and the floor."

Do you think Damian changed his habits quickly after finding his beloved wedding ring? Ermmmmmm..."The night I found the ring I immediately went back to my old habits – and slept with it on the locker. I was gone to work very early the following day and forgot it (my wife took a picture of the ring on the locker and sent it to me with the word “ahem”). I think it’s going to take a while for me to get used to wearing it again."

Should you tell your insurer if you find your wedding or engagement ring after you've claimed for it on your insurance?

You absolutely should. Whilst you might think it's been a long time and it doesn't matter anymore, not declaring it to your insurer will be considered insurance fraud.

How to claim for your lost ring with your home insurance company

If you still can't find it, you need to report it to your insurance company if you want to claim for it and get some of your money back. Get in touch with your home insurance provider if you have one, to check whether you have a valid claim (some have exclusions). You can also check the maximum amount you're likely to get back for it which depends on: your excess; the single item maximum value your policy will cover; and whether or not you still have proof of purchase or can get a duplicate from your jeweller. Also beware that a lot of insurers will refund the cost of the precious stones rather than the cost of the ring. If you've made a claim for a lost ring on your insurance policy, you can rate and share how well it went here.

If you have a specialist jewellery insurance policy

Why should you take on a specialist jewellery insurance policy when you have a home content insurance already:

- It's more tailored to your individual needs - home content policies tend to have lower value limits for single items.

- It might be better value for money than using your home content insurance to add a high value single item.

- The excess is normally quite low, especially compared to your home content insurance.

- You might get better protection away from home.

Check your wedding insurance

Like jewellery insurance, wedding insurance is specialist cover that will normally cover you for loss or theft of your wedding bands or your engagement ring, including during your honeymoon. Do check your terms and conditions very carefully and be mindful of exclusions.

Should you insure your engagement ring on its own

A lot of your decision will hang on the value of your ring. Home insurance (as in content insurance) can be a great option but bear in mind that:

- Claiming for a lost, stolen or damaged ring might affect your whole policy and premium (including your renewal price).

- Your compulsory excess might be rather high - According to Money Advice Service, a good home content policy should have an excess below £100 and no excess on accidental damage.

- You might have a lower limit on how much you can insure your ring for than with a specialist insurer.

How to find specialist jewellery or engagement ring insurance in the UK

- The quickest way will be to compare insurers through a service like MoneySuperMarket or CompareTheMarket.

- You can also go direct - Specialist insurers include THMarch, HighWorth insurance, AssetSure and ProtectYourBubble.

- Finally, do check the reviews and ratings other customers have shared about the insurer you're thinking of going with.

Cheapest insurance quotes don't always go hand in hand with great service or satisfaction when it comes to claiming on your policy. There are plenty of services where you can read feedback about an insurance brand from a general customer service point of view (Trust Pilot, Feefo...). You should also check the insurance social media mentions and reviews on Facebook. If you'd like feedback specifically about how they might handle your claim, you can head to our ClaimScore review pages. And if you've had a claim recently (with any insurance brand, it doesn't have to be jewellery insurance), why not take a couple of minutes to share your insurance claim experience and also help others buy their next policy more wisely. Just a thought.

Whoever you select, make sure you keep your original receipt or check that your jeweller keeps records of sales of engagement and wedding rings. Have them revalued regularly (every 3 years is advisable). Update your home or specialist insurance accordingly.

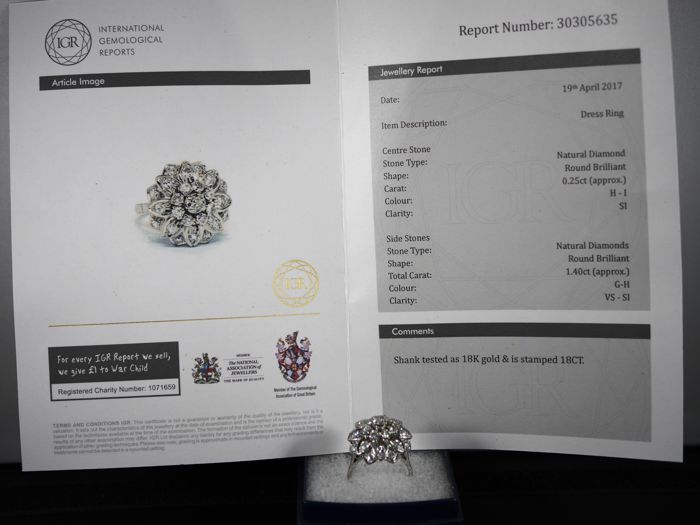

How to arrange jewellery valuation for insurance purpose

Your first point of call should be the jeweller that sold you the ring or get in touch with Hatton Gardens Valuation Team, but it's worth comparing the cost and value for money of the service you are buying.

Check these points before going ahead with your jewellery valuation:

- Professional credentials - National Association of Goldsmiths and ideally also a member of the Institute of Registered Valuers.

- Valuation lead time - Hatton Gardens valuation service is a same day service. Some might take a lot longer.

- Cover and protection - If you need to post the item for valuation, will your valuer send a courier? What happens if your ring gets lost? Local services might be an easier solution.

- Sample reports - They will give you an idea of how much information you get.

- Revaluation fees - typically you need to update your insurance policy every 3 years. Some valuers might offer the revaluation at a cheaper price than others and save you money in the long run.

- Personal recommendations - Little beats word of mouth when it comes to selecting a service, being a valuation or your next insurance policy. Ask your friends and family and leverage the power of social media reviews to check the reputation of the insurance provider you're thinking of using.

Why you should get a valuation

Head over to jewellery insurance specialist T.H.March. They make it very clear and simple: "If you need to make a claim on your March Plus Personal Jewellery & Watch insurance policy, we want the process to be as quick and easy as possible. An accurate valuation is priceless because it means we’ll already have all the information we need to be able to arrange for the replacement of your treasured item, usually with your chosen jeweller, very quickly. This is particularly important with bespoke designer pieces and it makes the whole process a lot easier."

You can also download their jewellery valuation checklist to save you time.

How much do people spend on an engagement ring

Beware - The 80s are making a comeback.

Hang on, what's this got to do with your engagement ring? Patience...

Look at the autumn/winter High Street fashion: H&M is awashed with Madonna's True Blue album cover tee shirts (1986 wasn't it?) and Back To The Future jumpers. Vogue reported electric blue outfits and padded shoulders at the Paris Autumn winter Fashion Show.

Here's the catch.

That decade was famous for one particular ad. That ad (or series of ads) changed how much it was deemed "right" to spend on an engagement ring. It really managed to do this. The ad campaign was commissioned by De Beers jewellers. After their original campaign (in which they cleverly used diamonds' long lasting qualities as the symbol of marriage with the catchline "A diamond is forever") they upped the stakes and rolled out a tweaked version: "how can you make 2 months salary last forever". 2 months. Indeed. That's a lot of money. And judging by their sales results, it convinced people big time.

However, more recent figures show that this perceived rule about how much you should spend on an engagement ring isn't a 'one for all' answer of course. At the end of the day, getting engaged and married should not be about how much the ring cost (well, certainly not at the top of your priorities, in our humble opinion). Here's what the experts say:

- Wedding expert website Hitched.co.uk reports that the average amount people spend on an engagement ring is £2,084 (showing a 17% increase in the last 3 years).

- Whereas jewellery retailer Diamond Heaven reported that the average cost we expect to be spent on an engagement ring is £1,650**

- More and more people are either doing away with a diamond engagement ring or even resell it to fund a house deposit or studying fees, according to MoneyMagpie.

- Women stated on average £445 more than men did when asked what was spent or will be spent on the engagement ring**

- London tops the price list of Brits who spent or expected to spend on the engagement ring at almost £4,700.00**

- Trends differ significantly across areas of the UK - check out this map created by William May jewellers:

Created by William May • View larger version

**The survey was commissioned by https://www.diamond-heaven.co.uk/ and independently carried out by www.censuswide.com. The UK sample size was 1,047 adults. Fieldwork was undertaken online between 5th - 14th September 2017. The figures have been weighted and are representative of relevant adult populations (aged 18+).

Diamond alternatives for engagement rings

Whilst diamonds are still synonymous with getting engaged and marriage and love forever, couples are also showing creativity and individuality with stunning alternatives. Some featuring diamond with other precious stones. Zirconia rings. And rings with no diamonds at all.

Hinna Azeem is the founder of H.AZEEM Jewellery, the award-winning brand specialising in natural gemstone jewellery set in sterling silver. Azeem's creations have been worn by Pixie Lott and Game of Thrones Maisie Williams. Hinna told us: "Alternative gemstones for engagement rings took off as early as the Art Deco movement in the 30s with big, gorgeous emeralds being preferred. The trend is only just re-emerging with celebrities opting for quirky alternatives; Kate Middleton’s gorgeous sapphire engagement ring (with a royal history, of course!), and Eva Longoria’s stunning ruby ring more recently. Modern brides are looking to carve a unique style for themselves and pink diamonds, tourmaline and sapphire are becoming increasingly popular. I went travelling when I was young and that’s when I too fell in love with brightly coloured gemstones – all of my designs are inspired by the colours and traditions of the globe's most beautiful precious gems!”

image credit - Inna Azeem collection

So whether you've lost your engagement ring or recently got engaged, we hope you will find the tips above helpful. If you have any other question around jewellery insurance, wedding insurance or honeymoon insurance or claims, let us know. Think we could add more places to look for a ring on our list? Tell us! It might help someone find theirs one day.

Even better, if you have got a story about having lost then found your engagement ring in a unusual place, get in touch. You might even get an Amazon voucher if your story is published as one of our case studies. You can email us, tweet us or leave a message for us on our Facebook page.

READ NEXT: What is personal belongings insurance and what do you need?

0 Comments

Please sign in to post a comment.