Why car insurance goes up (PLUS why it’s changing for your benefit)

If you are good at baking you’ll probably find this guide on car insurance prices easier to understand. How does that work?

Let's see. Are you struggling to understand why your car insurance renewal price has suddenly gone up, for no apparent reason? Even if you haven’t made a claim?

We're hoping this comprehensive guide will finally give you all the answers you need.

In this article:

- How to use this guide for your benefit

- What makes car insurance go up

- The 4 buckets that make up car insurance prices

- Is it all good news in 2018 for car insurance renewal prices?

- How much will your insurance go up by after a claim

- How can you save money with your car insurance

We’ve seen weekly threads on forums like Money Saving Experts and MumsNet, where people try to get answers about car insurance cost from other drivers. Sadly the answers to each thread can be conflicting or quite vague.

If you want to get a better grasp on how much your car insurance might go up by, you need to know why it goes up in the first place.

How to use our guide

It’s like knowing why a cake has risen

To understand why car insurance is going up, you need to study the recipe, its ingredients and methods as well as the tips from the experts. Now, the list of ingredients for making insurance products is rather long and complex. There can also be a lot of technical jargon. So we’ve come up with this comprehensive guide, all in plain English to help you figure it out and see where and how you might be able to save on your next car insurance policy.

Understanding insurance prices is like baking a cake…

3 ways to use our “why car insurance cost goes up” guide

READ IT - Read the whole guide end to end. It is long. We know this. It’s because we have tried to answer all the questions related to car insurance prices we have come across during our research. We have broken it down into easy to read smaller sections so you can also scan them and skip to the one(s) you need quicker.

BOOKMARK IT – to use as a reference guide.

SHARE IT - If you find it useful, isn’t it likely that some of your friends or family might do too? Use the social media links on this page to click to share.

Where we gather information from

To make sure we could give you a really useful guide on why your car insurance goes up, we have read through lots of reports, news and survey results including:

- The Association of British Insurers - 2018 industry report

- Confused.com - insurance price index 2018 Q1

- Changes brought in 2017 and 2018 by the Financial Conduct Authority, affecting the insurance industry in the UK

- GPAP Framework

- Financial Conduct Authority

- Auto Express Annual - Car insurers annual survey

- RAC and the AA statistics publications

We’ve crunched the stats, studied the facts and taken out the insurance jargon to create the guide below.

What makes car insurance go up year after year

Going back to the baking analogy, there are many ingredients involved in creating insurance prices as we will explain below. The method used to mix all those ingredients in the right proportion is also complex. But everything boils down to one essential element: RISK.

The 4 "ingredient buckets" used in the making of car insurance prices

BUCKET 1 - The reasons for price increase that you can influence (YOU)

These are the reasons you are most likely to know about. They all relate to how much of a risk you are (or are seen to be by your insurer). Risk is what people who create insurance policy prices analyse in minute detail. The higher the risk, the higher the cost. Most of them are common sense:

- Your car make and model

- Your age

- Your job

- Where you live

- How many years you’ve had your licence for

- What you use your car for

- Whether you are married or not

- Whether you have any convictions or driving penalties

- Did you protect your no claim bonus or not

- Number of years of no claim bonus If you’ve made a claim

- If you have reported an accident and not claimed (or haven’t heard back from the other driver yet)

HELP OTHERS TODAY - By the way, if you have made a claim recently, you could really help other people. WHY? When we buy a new insurance policy, we really just buy a promise. The promise that IF something happens (be it to your car, your home, your pet…), your insurer will make things easier, help you sort out the incident and pay you back for what it’s costing you. But the point is…we don’t really know how good insurers are at this part until it happens. And it could be a little late to discover that in fact they might not be epic at all. Or brilliant to discover that they are. Either way, wouldn’t it be great to know this in advance. Specifically about how they handle claims. HOW? You can now do this thanks to ClaimScore. ClaimScore is a community hub where you can write, read and share your experience as a customer of an insurance claim you’ve made to your insurer. Let others know so they are a little better informed before picking their own insurer. ClaimScore is free to use. Adding your review takes about 2 minutes.

Share your knowledge and add a review of your last insurance claim now >

BUCKET 2 - The reasons caused by drivers as a group of people

If insurers only had to look at you and your lifestyle to decide how much you need to pay for your car insurance, it would be relatively simple to figure out how much you might need to pay next year for your car insurance. But, insurers also have to think about how much they might have to pay out as a whole to drivers they insure. Their behaviour and the claims they make might impact the insurer’s overall view (and data) on risks and overall cost, impacting your own policy.

Added to this fact, insurers also need to look at the changes they anticipate might impact insurance prices in the future. For example, the ABI reported earlier this year that British insurers are expecting an increase in bodily injury claims, due to a change in a law that is used to calculate how much victims can be awarded.

“Motor premiums reached a record high at the end of 2017 Q3, at £485, £57 higher than the average motor premium at the beginning of 2016. Rising repair costs, repeated hikes in Insurance Premium Tax, and with the industry anticipating significantly higher bodily injury claims costs following the Ogden Discount Rate change in February 2017, all contributed to this trend.”

Source - ABI insurance market report Q1 2018

BUCKET 3- The indirect reasons

The insurance business can also be hit by changes that are not directly related to how you or other drivers behave on the road. For example, the Income Premium Tax (a tax that all insurers have to pay each time they sell a policy), has gone up to 12% and doubled since Nov 2015 alone. That’s around five times more than when it was introduced in 1994.

The increase in Insurance Premium Tax been estimated to cost the average household £47 extra a year

Other changes like the exchange rate and the increase of repair bills and spare parts can also be considerable factors which snowball into a price increase.

For example, The AA suggested that the rise in Income Premium Tax and insurance cost could increase the number of people choosing to drive without insurance. And at the same time, the Motor Insurers Bureau reported the first rise since 2004 in the number of claims against uninsured drivers!

BUCKET 4 - The “secret” reason why your car insurance has been going up just before you renew it

According to BBC Watchdog, around eight million people simply let their car insurance auto-renew, rather than look for a better deal. If you are one of them you could be penalised (until recently) for not questioning your loyalty. More on this further down, in the savings section.

Is it all good news in 2018 for car insurance renewal prices?

Shoots of good news have appeared in spring 2018 for UK motorists. But those need to be taken with a pinch of salt. Here’s why.

Fully comprehensive car insurance pricing falling in the UK (but don’t do a victory dance yet)

According to The Association of British Insurers, in the first quarter of 2018:

The average price paid for private comprehensive motor insurance was £478, down £13 on the last quarter of 2017, and the first quarterly fall in premiums in two years.

BUT

The average premium of £478 was up £14 (3%) on the same quarter last year – making it the highest Q1 figure on record.

So is it good news or bad news? Bit of both. Car insurance cost has been going down, but slowly, so it’s still more expensive (on average) than last year at the moment.

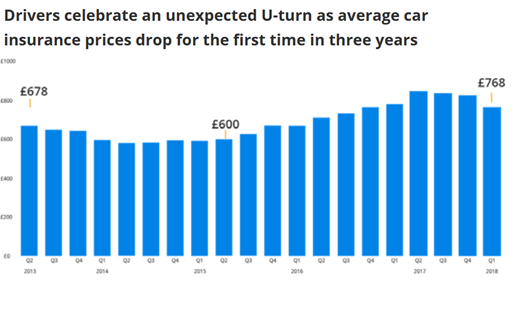

Confused.com who run their own annual insurance price index survey since 2006, share a similar trend (Although they share a significantly higher average car insurance cost of £768.00). [source – confused.com insurance price index Q1 2018]

[source – confused.com insurance price index Q1 2018]

British Insurers acting on renewal premiums excessive pricing

On 8th may 2018, All members of the Association of British Insurers (ABI) and the British Insurance Brokers’ Association (BIBA) - meaning the vast majority of UK insurers – have signed up to a new ‘Guiding Principles and Action Points’ (GPAP) framework. This promises to “address some of the issues in the current market that can lead to excessive differences between new customer premiums and subsequent renewal premiums”. In short, it should limit the last minute renewal price hikes you can be faced with on your car insurance.

The Guiding Principles and Action Points (GPAPs) apply to key personal lines insurance products such as home, motor and travel, but not pet or health insurance.

More transparency from your insurer about renewal prices

Th Financial Conduct Authorithy (FCA) introduced a new rule in April 2017.

This rule requires firms to clearly show the insurance premium a customer paid last year alongside their proposed renewal premium.

They also require firms to show a prominent, clear and straightforward message to encourage customers to shop around. The FCA has found that firms are still failing to properly implement the rules despite warnings in October about failings. They have warned that they could take action against general businesses which do not implement the new rules as a priority, which is great news for consumers.

Insurance market expert Louise O’Shea, CEO at Confused.com, backed up the recent changes within the insurance market promoting transparency: “Insurers now have to show us what we paid for car insurance last year. Therefore, it's never been easier for drivers to check what they paid then and compare it to what they are asking you to pay now.”

How much will your car insurance go up by after a claim

Sadly we can’t give you a figure just like that. If you have read this guide so far, you’ll understand that calculating the up to date insurance risk one person is perceived to carry is a complex exercise (and a specialist job). Once you’ve had an accident, whether it’s your fault or not, or even if you decide not to claim for it, the new facts the insurer has access to will trigger your renewal price.

If you decide not to claim, you still have to report the accident by law to your insurer. But why would your policy cost go up if you don’t claim or get money back? It’s all about the perceived risk again. Insurers have banks of data telling them whether having been involved in an incident now makes you more likely to have another one soon. If the data for your age group or where you live says so then your insurance might go up.

How can you save money with your car insurance

We have looked around for you and also checked what other market experts know.

Shop around at renewal

Even with all the changes we mentioned above, it’s still definitely worth shopping around.

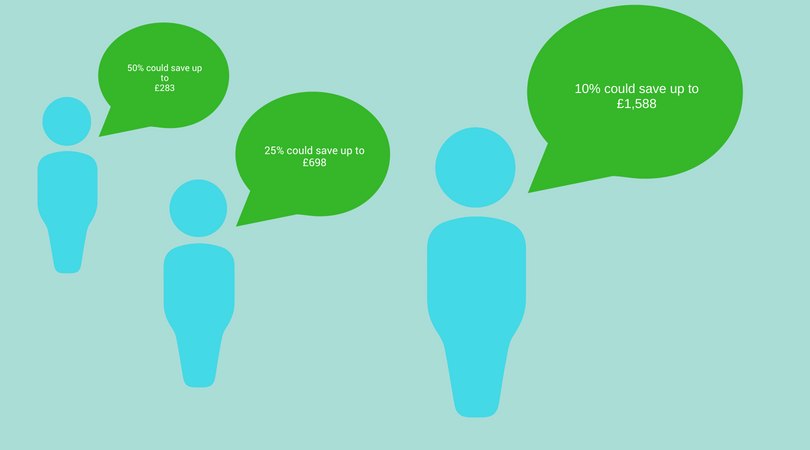

50% of customers could save up to £283.83 on their car insurance

Here are the results of an internal survey that insurance comparison giant 'Compare The Market' have shared, based on an online independent research by Consumer Intelligence during February 2018:

- 50% of customers could save up to £283.83 on their car insurance

- 25.81% of customers could save up to £698.60 on their car insurance

- 10% of customers could save up to £1,588.59 on their car insurance

Even if you remain with your insurer, haggle with them. Money Saving Experts have reported an 80% success rate in haggling with companies, including the AA, RAC, Admiral and Sky (Nov 2017 poll - 9000 entries).

Adopt Telematics

Telematics, or lack box technology, can help lower your car insurance as a young driver, by monitoring how safely you drive and helping you improve your driving with feedback sent directly to your mobile phone through an app.Talking about mobile phone, unless you have a hands free solution in your car, your phone must be tucked away out of sight and out of mind. Some people place their bag and phone in the boot of their car to suppres any temptation to glance at it whilst driving and get disctrated. The glove box is another good place to store it. Removing the biggest distraction drivers face these day can help massively towards keeping you focused on the road and your driving behaviour as safe as it can be. At the Young Drive Focus 2018 conference held in Pall Mall at the RAC, Selim Cavanagh, CEO of Telematics specialist ingenie.com stated that "While the link with speeding and crashes remains our concern, it's not enough to focus solely on conversations about speed. Poor driving behaviour can be linked to harsh braking, sharp cornering, general complacency and the big one: distraction. Ignoring the facts is no longer an option."

Research your next car for insurance benefits

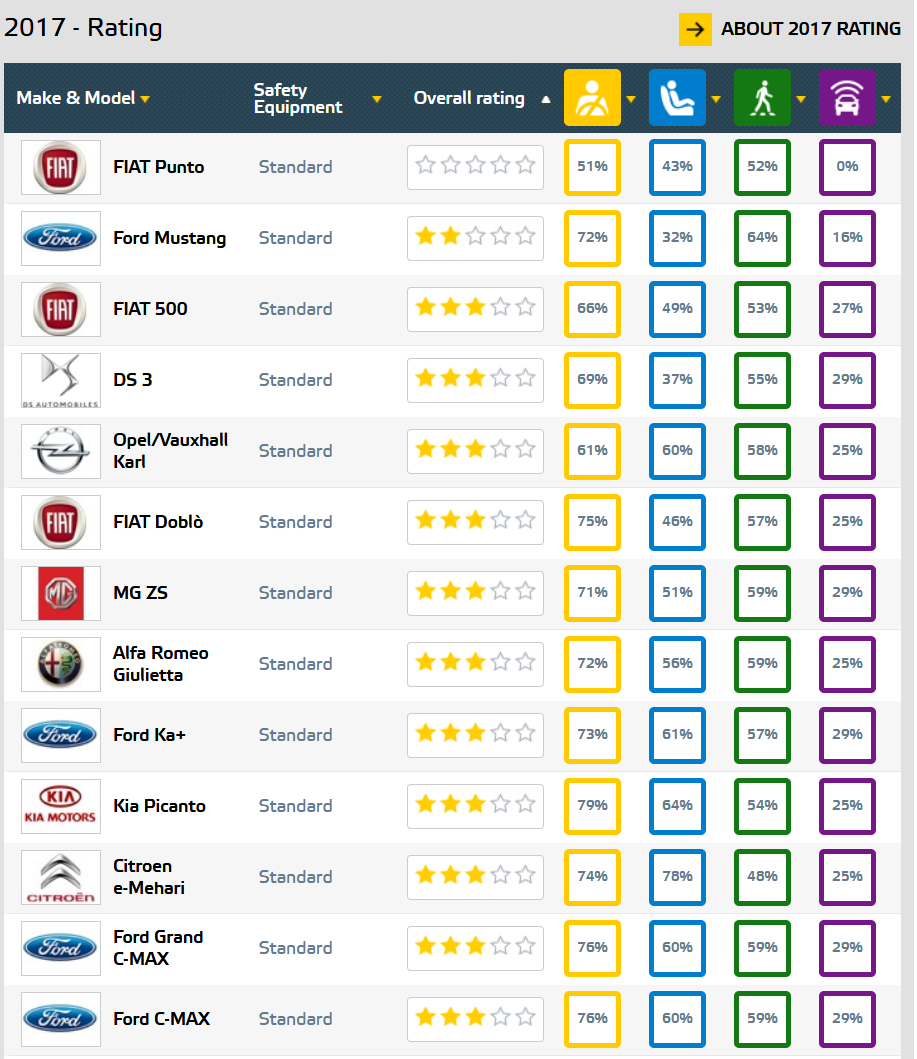

Aside from the make, model and engine size of your car, an important factor in your insurance cost “recipe” is the safety rating of your car. You can check how the car you are planning on buying compares to others on the EuroNCAP webite. Volvo SUVs performed well alongside Volkswagen and Subaru across new models launched in 2017:

At the other end of the table, the Fiat Punto performs a lot lower when it comes to ensuring the safety of driver, passengers and pedestrians (all were compared with standard safety equipment rather than the addition of a safety pack):

If the car you are looking at is older, you can check safety ratings as well on the EuroNCAP website. There are annual lists for cars up to 2013, then groups for 2009-2012 and older than 2009.

If you like this article, let others benefit from it too.

Was this article useful? Any comments or questions? Pop them below.

Find out if you could save money on your car insurance from the insurance experts mentioned in this article *

Ingenie (Telematics for young drivers 17-25)

NOTE: We may receive a small commission from these companies for referring you to them.

0 Comments

Please sign in to post a comment.